Customer Story

Sovos Compliance uses the GeoTAX solution to deliver tax compliance advice more accurately and quickly

1 bn

transactions served annually

1979

company founded

100,000

customers

Overview

Companies that sell products or services in several different tax jurisdictions face complex and diverse tax rules. For example, clothing retailers in Massachusetts must collect sales tax, but only on transactions above a certain threshold. In many states, food destined for home consumption is exempt from taxation, but food served in restaurants is taxable. In Phoenix, businesses may have different sales tax rates, depending on which side of the street they are on. And many ecommerce sales that cross state lines incur different tax rates than in-state transactions.

These types of tax complexities have driven many retailers, manufacturers and other firms to seek assistance from Sovos Compliance. The company’s software-as-a-service (SaaS) Intelligent Compliance Cloud helps clients understand all their tax obligations, regardless of where they choose to operate.

Challenge

The Intelligent Compliance Cloud automates the determination of taxes owed on each sales and purchase transaction initiated by a Sovos Compliance client. Sovos processes more than 1 billion 1099-reportable transactions per year on behalf of clients around the world.

Sovos systems analyze all the transaction information to first determine which taxing jurisdiction the transaction occurs in. The systems assign what it calls a “geocode” for that location.

The Intelligent Compliance Cloud then applies the appropriate tax rules for that jurisdiction based on what product is being purchased, where the product has come from, where it’s going, and who’s buying it, to calculate any sales and value-added taxes that the client owes.

“We then return that result to our customer,” says Pawel Smolarkiewicz, VP of product management for Sovos Compliance. “The seller adds that tax to its invoice, so that’s what it charges its customer. Making sure you have the right tax jurisdiction is obviously crucial in this process. You have to know the jurisdiction in order to apply all the appropriate tax rules and rates, and then be able to report and pay those taxes to the correct jurisdiction.”

The penalties for an organization that charges the wrong taxes can be serious. “If an audit reveals that a business has collected too little sales-and-use tax, the company will be on the hook for both the tax and, most likely, interest and penalties for getting it wrong,” Smolarkiewicz says. “On the flip side, if companies charge too much tax, they may face customer support issues and they can be sued.”

Previously, Sovos Compliance used a system that determined tax jurisdiction based on ZIP Codes. The location lookups weren’t precise enough to always return accurate tax information.

“In some states, like Colorado, jurisdictions overlap,” Smolarkiewicz explains. “A single ZIP Code may actually encompass three or four different tax jurisdictions. We, or our client, would have to determine which of the jurisdictions was appropriate for the transaction, but we often didn’t have enough detail to ensure a correct match.

“With the rise of ecommerce, and more vendors shipping products across jurisdictional lines, we needed a more detailed address lookup system that could pinpoint location to an individual rooftop.”

Industry

Software solutions

Overview

- Provides tax compliance and reporting solutions to companies in industries including retail, manufacturing, and financial services

- Serves more than 1 billion 1099-reportable transactions annually on behalf of clients in the U.S., Latin America, Asia-Pacific, and Europe

Solution

“Because we’ve been able to build rooftop-level geocodes into the system, it always ensures that a single, accurate result is returned.”

Pawel Smolarkiewicz, VP, Product Management

Sovos Compliance

“Precisely was very responsive during the implementation; they were willing and able to help us out anytime we needed a hand.”

Pawel Smolarkiewicz VP, Product Management

Solution

In addition to precision, Sovos Compliance was looking for an address lookup solution that would not slow down the Intelligent Compliance Cloud. “We were also looking for a partner that had a deep knowledge of the issues around indirect tax and sales tax, in the United States and beyond,” Smolarkiewicz says. “We needed a partner that would work with us to make corrections or enhancements when necessary.”

After considering three solutions, Sovos selected GeoTAX from Precisely. Integration of the solution’s tax-lookup functionality into the Intelligent Compliance Cloud went smoothly. “Precisely was very responsive during the implementation; they were willing and able to help us out anytime we needed a hand,” Smolarkiewicz says. “That’s why we were able to integrate the GeoTAX solution into our SaaS solution very quickly.” Now, every time an order comes into a Sovos client, the seller’s system provides the GeoTAX solution with the address. Using proprietary Precisely address data, the GeoTAX software cleanses the address information, then provides a geo-code that indicates the specific sales and value-added tax rates for that jurisdiction.

“We have a great relationship with Precisely. As taxes have gotten more complex, their functionality has become more and more integral to our solutions. Precisely helps us keep our clients happy.”

Pawel Smolarkiewicz, VP, Product Management

Sovos Compliance

Benefits

Sovos Compliance has confidence in the returns from the GeoTAX solution. “Because we’ve been able to build rooftoplevel geocodes into the system, it always ensures that a single, accurate result is returned,” Smolarkiewicz says.

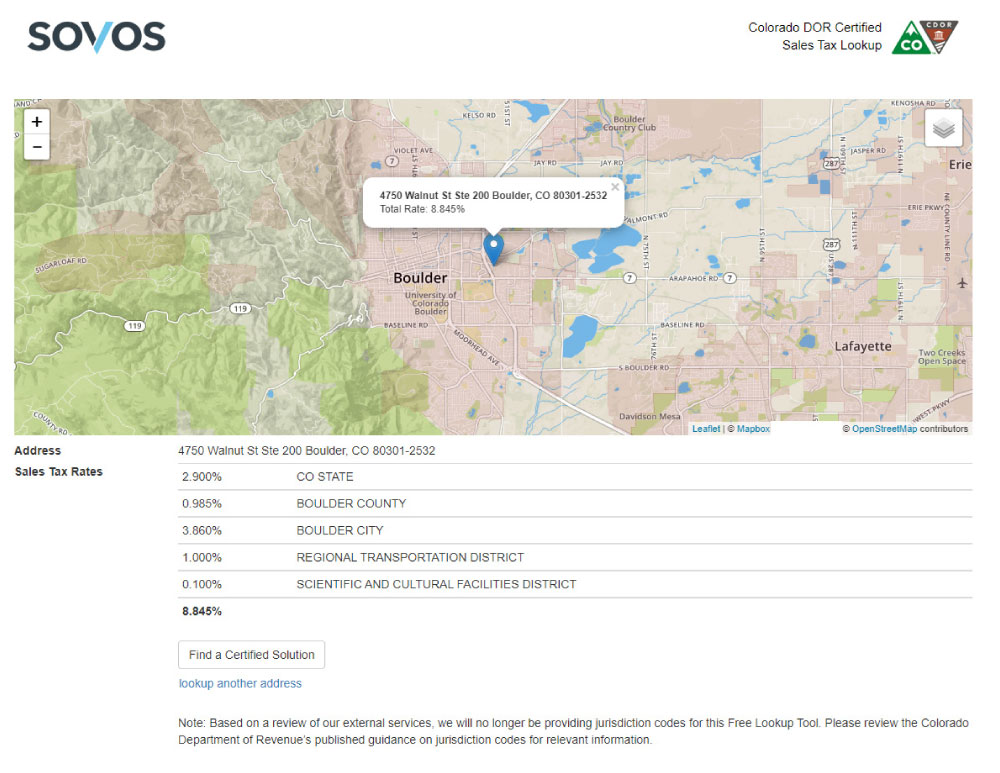

The results are so accurate that the State of Colorado agreed in August 2016 to hold harmless any organization that uses the Sovos Sales and Use Tax solution, in the event that its sales and use taxes are calculated incorrectly in the state. (See Figure 1.)

“Colorado is one of the hardest states in which to determine the correct tax jurisdiction for a sale,” Smolarkiewicz says. “But after running a test, the state government certified our system, which uses the Precisely solution for jurisdictional lookup accuracy. In fact, they have so much confidence in the accuracy of the Sovos jurisdictional assignment process with the Precisely GeoTAX solution that state employees use our cloud solution to look up the appropriate jurisdictions when a new company registers or when auditors are checking a company’s records.”

Prior to implementing the GeoTAX solution, Sovos was concerned that a more precise lookup system might slow down the functioning of the Intelligent Compliance Cloud, but that fear has proven unfounded. “The Precisely address-cleansing piece is very quick, and there’s no lag when the system assigns those addresses to our geocodes,” Smolarkiewicz says. “We have a great relationship with Precisely,” he adds. “As taxes have gotten more complex, their functionality has become more and more integral to our solutions. Precisely helps us keep our clients happy.

Figure 1: Powered by the Precisely GeoTAX solution, the Sovos Intelligent Compliance Cloud shows all the overlapping tax jurisdictions that impact a particular address, and its map-based interface makes tax information easy to understand.

Spectrum Enterprise Tax

Remove the guesswork in tax jurisdiction assignments by identifying accurate local tax rates instantly