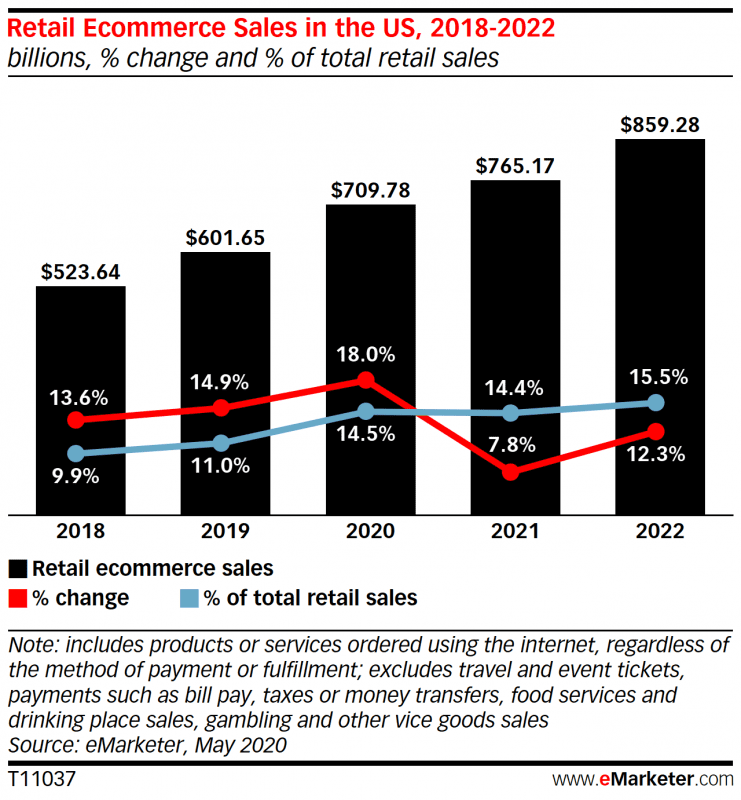

Online shopping has been steadily becoming more popular for several years and has seen a huge increase with the pandemic forcing the temporary closure of brick-and-mortar stores. A recently published study by eMarketer shows that US consumers will spend $709.78 billion in 2020 on ecommerce, which is an increase of 18% over 2019 while brick-and-mortar spending is expected to decrease by 14% to $4.184 trillion. This increased volume on the affected retailer’s ecommerce sites can open the seller up to a major tax liability if they are not using an accurate tax jurisdiction assignment solution.

US tax jurisdiction is complicated

There are nearly 19,000 different combinations of taxing jurisdictions in the United States, and their boundaries do not align with the ZIP+4 or ZIP Codes that many tax jurisdiction assignment tools use today.

The state and county boundaries are easiest to define and maintain since they rarely change. Municipality and Special Taxing Districts however are a different story as they frequently change.

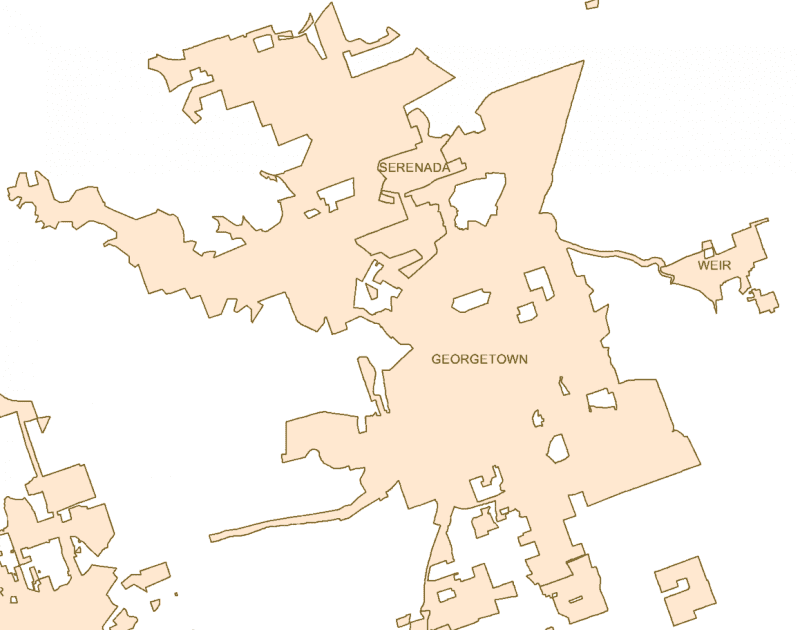

The complexity of municipal boundaries ranges from very simple and straightforward easily defined shapes to extremely complicated shapes with unincorporated enclave areas (unincorporated areas, completely surrounded by a city, usually with different tax rates) within their boundaries.

The example below shows the municipal boundaries for the cities of Georgetown, Weir, and Serenada in Williams County Texas. You can see in the image how irregular the lines of the boundaries are (shown in tan) and that there are unincorporated enclaves (shown in white) within the boundaries of Georgetown. These unincorporated areas are common across the country and can cause a lot of confusion and inaccuracies when considering appropriate tax jurisdiction assignment. We like to think of tax jurisdictions as contiguous boundaries that start in one area and end when they meet up with the next one, but in reality, they are much more complex.

Another type of tax jurisdiction is called a Special District. Special Taxing Districts are usually created to fund special services (transportation, emergency services, etc.) or public projects such as stadiums. These districts can be the same as a county or a municipality, but most are not. They can be large enough to cover several counties or as small as a single parcel of land. The Special District area is determined by what is being supported, where it will be available, and who is benefiting.

While the revenue collected from municipal and Special Districts is used to fund different things, they can be extremely complex and are constantly changing. Annually we see as many as 30% of the boundaries change through annexation, de-annexation, as well as the introduction of new districts and the removal of others.

Try it for free

Make Money. Easier.

GeoTAX is an easy-to-use web application that helps vendors of taxable goods and services instantly assess local tax rates.

Accurate location is key to accurate tax jurisdiction assignment

A taxation solution can have the best boundary information in the world. But if you can’t accurately locate your customer’s address, you might as well be throwing darts at a map on the wall.

Consider a tax area where a street is the reference for the tax boundary between two jurisdictions. To accurately assign a tax rate, it is critical to know what side of the street the customer is located, as well as the location on that street block. The most accurate solutions will pinpoint your customer’s address to the correct parcel or building regardless of whether the postal service delivers mail to their address.

Close is not good enough and getting the location wrong, can mean you are out of tax compliance. Be sure your solution will accurately determine your customer’s tax rate by address and safeguard your business from inaccurate tax jurisdiction assignment.

Putting it all together for seasonal shopping and ecommerce

With the increased levels of online shopping it is more important than ever for sellers to have an accurate tax solution that they can rely on.

Consider an instance where you have a frequent buyer that is being taxed at the wrong rate and/or their taxes are being remitted to the wrong jurisdictions. Extrapolate this across all your web traffic and the audit liability increases proportionally throughout the year. Anyone who has been audited knows how disruptive, time consuming, and potentially expensive they can be.

It doesn’t matter how large or small your business is, getting the tax jurisdiction assignment right will positively affect your bottom line. Learn more about how Precisely assists sellers determine accurate tax jurisdictions and rates with Spectrum Enterprise Tax.

Try a web-based version of our tax solution for free at GeoTAX.com