Demand Insight Financial

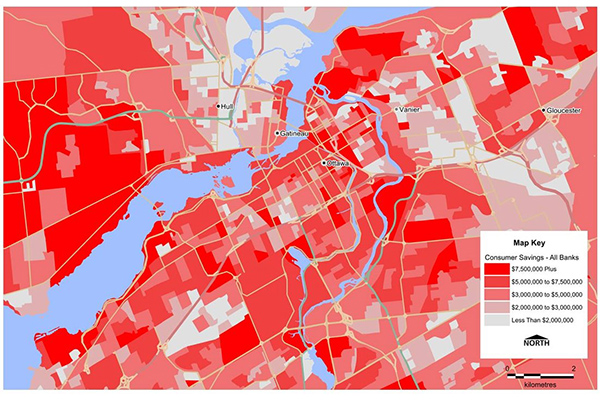

Demand Insight Financial provides current estimates and five-year projections of branch-based demand for twenty consumer and small business banking products. Tens of millions customer records from financial institutions across the U.S. and Canada, together with hundreds of demographic variables, produce the most accurate neighborhood-level forecasts of total wallet available.

The data has been cleaned and organized, and is updated annually. Users can easily map and visualize the data, and create reports for any standard or customer geography.

Benefits

- Enrich business data with critical insight for proper analytics and planning

- Improve market assessment, branch planning, and targeting

- Use with your existing GIS and database tools or within larger solutions for predictive analytics, location intelligence, and customer engagement

Details – United States

Current and five-year consumer, retail (residential + workplace) and small business demand forecasts for the following categories:

Deposits

- Non-interest checking

- Interest checking

- Savings

- Money Market

- IRA

- CDs

Loans

- Direct auto loans

- Revolving loans

- Credit card

- Home equity

- Installment loans

- Mortgages

Investments

- Annuities

- Mutual funds

- Brokerage

Details – Canada

Deposits

- Non-interest checking

- Interest checking

- Savings

- RRSPs/RESP

- Term deposits/GIC

- Tax-free savings

Loans

- Direct auto loans

- Revolving loans

- Credit card

- Home equity

- Installment loans

- Mortgages

Investments

- RIF/Annuities

- Mutual funds

ooioioiiiooioioiioiiooioiiiooiooiiioioioiiiooioioii