Wildfires: once merely an afterthought for the insurance industry, these destructive events have increasingly become more of a risk factor for underwriters to consider. It makes sense that with the low demand for wildfire risk data historically, there had not been much in the way of powerful tools and resources that could accurately gather this information for insurers – but this is not the case anymore.

In a two-part interview with Gen Re, I was able to share some perspectives on wildfires that the insurance industry should be aware of in their underwriting.

Here are three of the biggest takeaways from the interview – and they may surprise you.

1. Broaden the scope of your evaluations

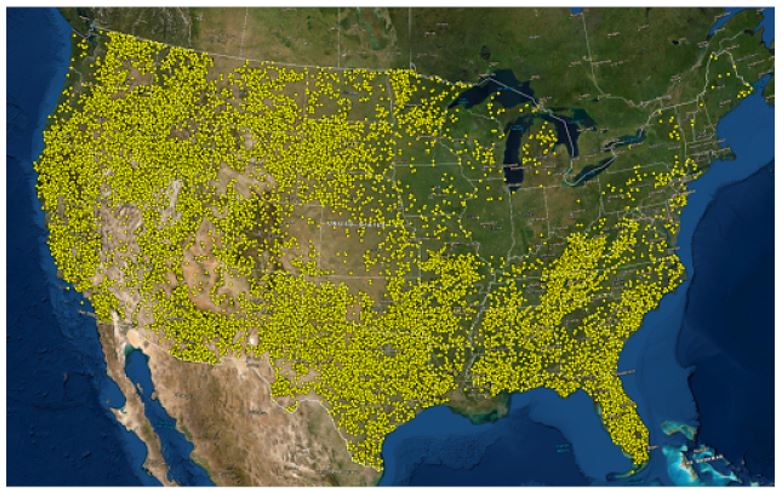

It’s not just the western-most states that are at risk. Fires, including significant fires, occur throughout the U.S. The image below shows fires of over 100 acres that have occurred nationally from the early 1990s through 2015.

Here are a few statistics and fires that are particularly noteworthy:

- In 1998, Florida experienced over 2,200 fires that destroyed 337 homes, 33 businesses and forced the evacuation of thousands.

- In 2016, on behalf of FEMA, we investigated the Chimney Tops 2 Fire in Sevier County/Gatlinburg Tennessee. Over 2,000 buildings, many commercial, were damaged or destroyed and 14,000 people were evacuated.

- In 1995 a fire broke out near Southampton on Long Island, New York (yes, Long Island!), running 7,000 acres and burning numerous homes and small businesses. And again on Long Island in 2012, the Brookhaven Blaze burned 2,000 acres.

- In New Jersey, the Pine Barrens area has a significant fire history. In 1963, fires burned more than 183,000 acres in an event nicknamed “Black Saturday”. In 2016, Rolling Stone magazine published a piece that asked, “Will America’s worst wildfire disaster happen in New Jersey?”. The combination of volatile vegetation, in the Pine Barrens region, and extensive development in that area, does set the stage for a catastrophic event that may also endanger many lives.

Eastern states have a lower probability of experiencing a catastrophic event but the vegetation in many areas can exhibit extreme fire behavior under the right conditions. This, in combination with a much denser development pattern than in the West, gives us concern in some areas. The list of fires east of the western 13 states goes on and on. Outside of the Chimney Tops 2 Fire, the magnitude of loss doesn’t compare with the West – but, what we saw in Eastern Tennessee was scary. We hope it doesn’t represent the new normal, but we need to be prepared for the possibility.

2. Don’t forget about the insects, disease, and local mitigation

When I’m asked about wildfire risk and the less obvious underlying conditions to underwrite against, two elements come to mind. The first would be insect and disease outbreaks, and the second is local mitigation.

There are many insects and diseases that cause vegetation defoliation and mortality in the U.S. The West experienced massive epidemics in recent years. This has created large-scale tree mortality in many areas.

One of the hardest fire behavior calculations is trying to predict how a fire will behave in conifer (evergreen) forests that are, as we say, “red and dead”. Tree mortality happens in phases, and each phase brings a host of different burning behaviors. Wildfire severity and probability is directly tied to the health of the forest, and this element is difficult to assess but essential to capture in a wildfire risk assessment.

Read the Whitepaper

Wildfire Risk – A hazard and risk assessment database

Read this whitepaper which contains information about wildfire risk model assessements and how they can be used in business and programmatic analytics.

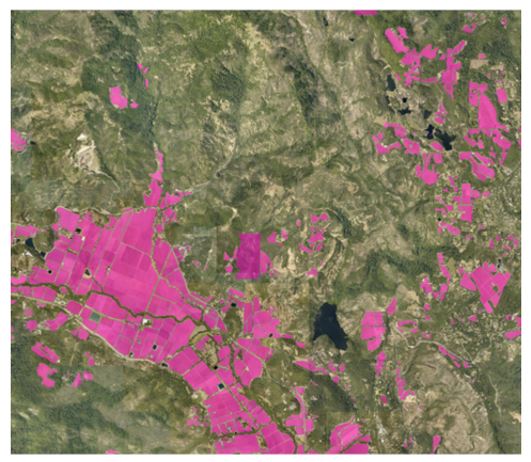

The second element is local mitigation or land features that have a positive or diminishing effect on fire behavior. We aren’t talking about defensible space here, but rather landscape-scale mitigation. Mitigation can be in the form of fuel reduction projects conducted by federal, state, or local agencies. More common but less obvious forms of mitigation in the form of golf courses, bare ground, large water bodies, even some agricultural crops – whether man-made or natural – change fire behavior for the better and must be integrated into a risk assessment.

As an example, the graphic below shows vineyards in the Napa Valley which have been shown to slow fire-spread and help protect homes adjacent to them.

3. Even once the flames are extinguished, other risks arise

Unfortunately, surrounding communities are not quite risk-free once a wildfire has run its course. In fact, they’re at risk for mudslides and debris flow for months after the fire. What (re)insurers need to know is that there are several factors that can determine the frequency and severity of these events taking place.

The main factors contributing to post-fire flooding are the predicted fire intensity, the soil type, the ruggedness of the terrain, and the probability of a significant rain event after a fire. These factors all contribute to the depth, velocity, and force of the flow. Precisely teamed with a company that specializes in this field, RESPEC, to develop tools for underwriting. We focus on pre-fire predictions, determining areas that are at risk of post-fire debris flow and or flooding before the fire.

After determining how intense and how long (“resonance time”) a fire will burn in a specific area, you can then apply the soil characteristics and ruggedness factors. Once a baseline has been established you have to look at the probability of occurrence in both the fire event and the weather event. For this, we run 2-, 10-, 50-, 100-, and 500-year rain scenarios to understand the spatial changes in flooding from pre-fire to post-fire.

What I have found very interesting is that in post-burn conditions it may only take, let’s say, a 1-2-year rainstorm to generate the same water depth, velocity, and force of flow that would result from a 50–100-year storm. This means that in certain areas, the probability of experiencing a destructive post-fire event increases materially.

We have run this methodology against the 2018 Montecito debris flow event. The USGS conducted inundation mapping and CalFire conducted damage surveys from the event. This allowed us to calibrate and validate the methodology. I really like the integration of these disciplines, fire, and hydrology, to be able to predict areas that are vulnerable to post-fire flooding and debris flow.

Getting what you need to evaluate wildfire risk

We developed our risk assessment database, Wildfire Risk, to account for physical, climatic, and manmade variables. Drawing on a large variety of data sets, both inside and outside the public domain, the product paints a picture of wildfire exposure for underwriting, pricing, portfolio analysis, and loss estimation across the United States – not just those western-most areas, as we discussed earlier.

Wildfire has truly become a primary peril for governments, individuals, and insurers. With better tools and data, we can all reach better predictions and outcomes. In my business, that’s what it is all about – and that’s why I encourage you to learn more about Wildfire Risk here.

To learn more about taking a data-driven approach to understanding and mitigating wildfire risk, read our whitepaper Wildfire Risk – A hazard and risk assessment database which contains information about wildfire risk model assessements and how they can be used in business and programmatic analytics.

For more insights from my chat with Gen Re, read the full interview (Part 1 and Part 2).

Author’s note: at the time of the Gen Re interview’s publishing (2020), I was the Chief Operating Officer of Anchor Point Group LLC, and am referenced as such in the interviews. This was prior to Precisely’s acquisition of Anchor Point in 2021.