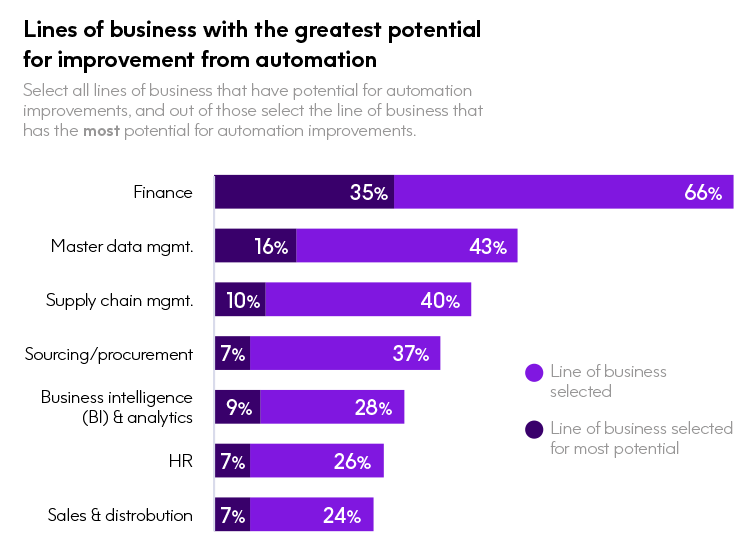

Finance is the “low hanging fruit” line of business for automating SAP processes, with a significantly greater potential for improvement over other areas. It’s followed by master data management, which is consistent with the findings that data quality and master data related concerns are highly-ranked issues standing in the way of automation.

Finance tops the “top four” business lines

To help organizations realize the greatest value and ROI from their investments, our survey asked respondents where they see the greatest potential for improvement from automating SAP processes. Finance topped the list by a significant margin in the total number of responses (66%) and as the line of business with the most potential for improvement (35%). Business-critical finance processes involve both transactional and SAP master data and need to maintain the highest quality and integrity possible. Automation can deliver higher data quality and auditable governance to processes, thus making it a natural fit for finance processes.

Following finance is SAP master data management (43%). This area offers significant ROI potential because acquired skills, tools, and practices can be applied to SAP automation across multiple business lines.

The potential value of automating supply chain management (40%) and procurement (37%) business lines is confirmed by our experience helping customers automate SAP processes for the past two decades. In fact, with the disruptions we have seen since 2020, these areas have become a greater focus for companies looking to gain more agility and flexibility in their logistics and procurement processes. The ability to respond quickly to an unexpected hiccup in a supply chain while maintaining governance and high data quality is critical for creating and maintaining a competitive advantage.

Evaluating the remaining business line results

We are unsurprised to see analytics, HR, and sales & distribution falling below the top four selected responses. While workflow robotic process automation is employed for these business lines, they are less data driven and farther from directly impacting the bottom line than ERP-related processes. However, we are cautious about the findings around plant maintenance (20%) and enterprise asset management (15%). We know that automation can significantly reduce complexity and improve productivity and performance for these lines of business, and we note that job roles associated with these business lines are not well represented in the survey group.

Read our Report

The 2023 State of SAP Automation Report

Working with the Americas SAP Users Group (ASUG), Precisely conducted a research study to identify the importance, challenges and opportunities that automating complex, data intensive SAP processes presents for enterprises.

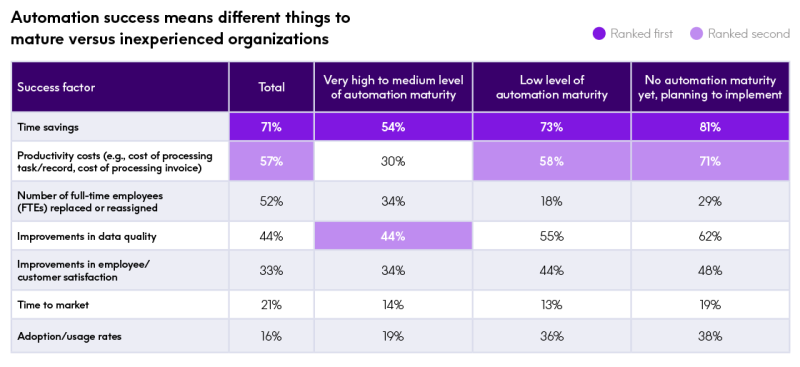

Measuring the success of automation efforts

How do organizations measure the success of their automation efforts? We looked at survey responses by the level of automation maturity to see what differences there might be between mature organizations and those with low or no experience with automation projects.

“Time savings” is the most commonly cited measure across all three categories of respondents, which makes sense intuitively. Automated processes typically run faster than manual ones. And time savings aligns with the selection of “Improves efficiency” as one of the two leading benefits of automation.

Interestingly, respondents with “medium,” “high,” or “very high” maturity levels ranked “Improvements in data quality” as the second most important measure of success, with productivity cost reduction (cost of processing a task, record, or invoice) in fifth place. The less mature counterparts both placed a higher value on cost, ranking it in second place and data quality in third. Mature organizations also placed a significantly higher value on replacing or reassigning full-time employees (FTEs) than less mature organizations. We believe much of this workforce optimization will focus on enabling citizen developers within individual business organizations to drive greater efficiencies.

Overall, the responses to the questions about business lines with the greatest potential for automation improvements align with our experience. The complexity and critical nature of the most frequently cited business lines — finance, SAP master data, supply chain management, and procurement — align with the SAP processes supporting data creation and maintenance for G/L accounts, materials, vendors, and customers. Organizations building a business case and seeking funding support will likely find more fertile ground among automation projects for these lines of business. They can also take cues for building a business case from how mature organizations measure success.

For more on the latest automation trends and insights, and what they mean for your business, read the 2023 State of Automation Report.